Stay Updated

Stay informed with our deal announcements, our market insights, and our research concerning founders and families pursuing their most complex strategic and financial challenges.

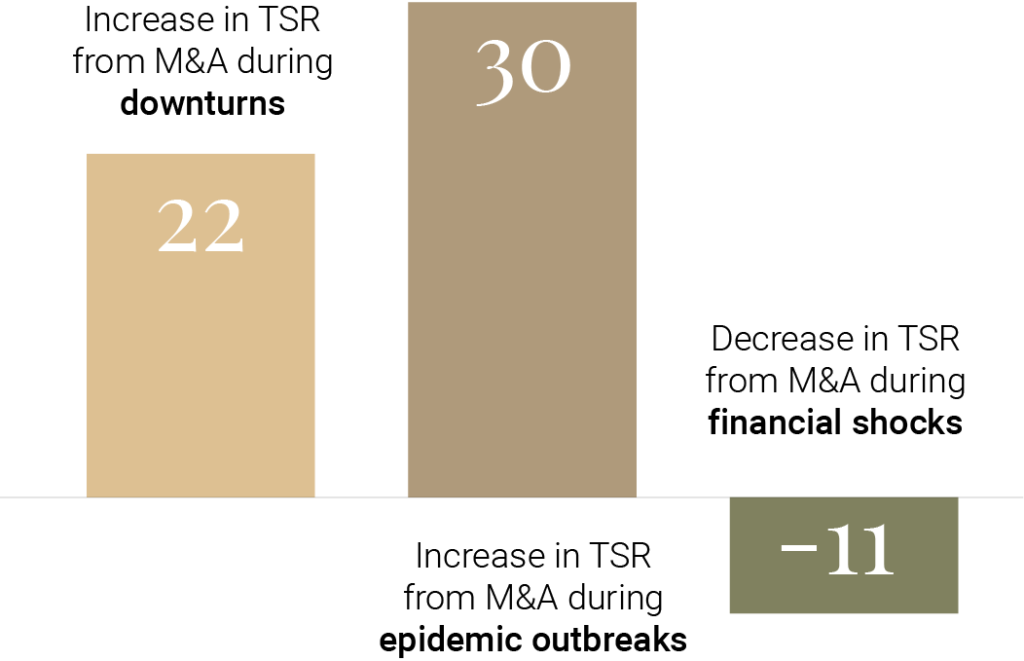

Company founders might be surprised to learn what attributes acquirers are looking for in potential candidates during unpredictable times. As the following chart indicates, firms who have acquired companies during downturns and epidemics have demonstrated higher total shareholder return (TSR) relative to their sector averages.

Firms who bought in a downturn turn to have a higher three-year total shareholder return (TSR) than their S&P 500 sector average

On the surface, these higher returns appear to be the result of buyers merely being opportunistic and “buying on the dip”, or paying a lower price during a crisis then benefiting later when market conditions improve. While “buying on the dip” is undoubtedly a factor in more than a few of the cases behind the data, I argue that these returns are more likely the result of buyers being able to identify and close deals with companies that are resilient by design.

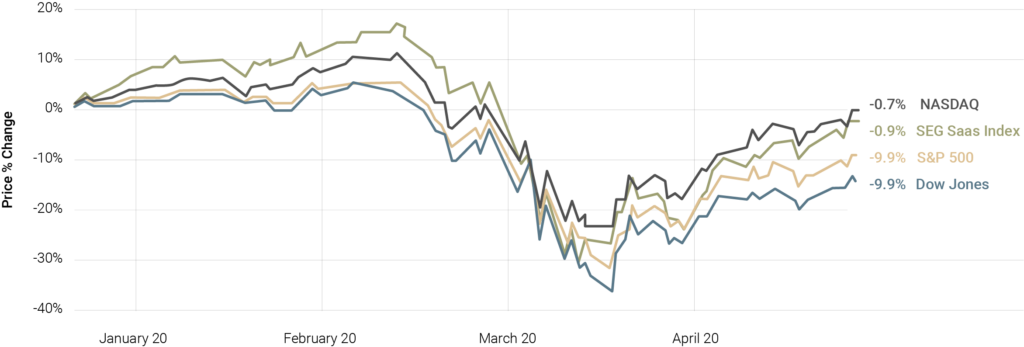

Let’s look at what the data is telling us. Public market valuations crashed broadly in March but certain sectors bounced back rapidly during April and today they remain higher than their broader indexes.

Among these high performing sectors are the so-called SaaS companies (see graph below). Furthermore, many market observers correctly anticipated that M&A activity would grind to a halt due to the pandemic. Nonetheless, many deals did in fact survive the onset of the crisis and closed despite the widespread slowdown, as reported by global law firm White & Case.

The improvement seen in public trading multiples among SaaS companies during April, as well as the encouraging data on actual deals closed during the pandemic tells us a lot about which companies are demonstrating resilience.

Let me share a story that is even closer to home: I recently advised Neutrona Networks, a SaaS-enabled networking company whose owners decided to sell in 2019. By the start of 2020, the company and its owners had secured attractive offers and proceeded to negotiate one of the offers with a company called Transtelco. The buyers were very committed and well into the acquisition process when the pandemic suddenly hit. Gloomy global forecasts caused the markets to tank. Company valuations slid across all industries.

Perhaps they were being opportunistic in that moment, or maybe they were being cautious with their capital, but Transtelco halted the process a few days before the scheduled closing.

Neutrona’s business hadn’t been affected by this crisis. In fact, there was reason to believe the underlying macroeconomics of increasing online work patterns and demand for cloud-based infrastructure accelerated by the crisis could actually work in their favor. My client had built on-demand networks that were nearly impossible to replicate without an enormous investment of time, money, and knowhow. They had designed and automated highly valuable and repeatable processes that were the envy of the industry.

In truth, Transtelco never stopped recognizing what it saw all along – Neutrona’s advantages and its resilience in the face of the crisis. Neutrona’s leaders had erected high barriers to entry and a deep and wide competitive “moat” that would pay dividends to new owners long into the future. The buyers proceeded to close under the original deal terms. Neutrona’s valuation never needed discounting.

While many seemingly comparable companies struggled to stop their values from eroding, Neutrona didn’t have to react to protect its valuation. The company was intentionally designed and built to be resilient, to absorb shocks and thrive. They had survived the challenge posed by the global crisis because their company possessed resilience.

So What Exactly Constitutes Resilience?

Certain performance indicators are linked to the kind of resilience that Neutrona showed throughout its recent M&A process, or that many SaaS companies demonstrated as their prices bounced back quickly in the midst of the recent market meltdown. They include:

It is no accident that these attributes are also closely associated with the 8 Drivers of Company Value — a framework for measuring and influencing company value. The lessons of the 8 Drivers framework are increasingly being recognised by buyers and sellers as central to getting M&A deals over the finish line and obtaining high valuations. Founder-led companies and their owners will achieve resilience by first committing to their own “sellability” as a key plank of their business strategy, and in turn doing what it takes to score high on the 8 Drivers of Company Value.

In Conclusion

For companies contemplating their M&A or capital market readiness, you should be asking whether your company has the resilience to maintain its value during a downturn — whether it is attractive enough to sustain buyer interest both inside and outside of a crisis situation. Given the swiftness with which crises like the pandemic have impacted companies of all sorts, resilience isn’t something you need to address in the near future. If you are approaching a transaction, it is something you probably should have addressed yesterday.